Needless to say, this makes for a ridiculously complex tax code. There are thousands of possible deductions created from years of Congress wanting to incentivize this or that behavior. One area where the tax code remains simple, however, is the basic income tax.

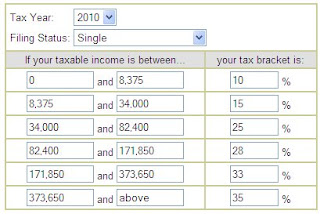

Take these numbers from the IRS, detailing how much each level of income is taxed:

To take an example, suppose your taxable income (after deductions and exemptions) was exactly $100,000 in 2008 and your status was Married filing separately; then your tax would be calculated like this:

This puts you in the 28% tax bracket, since that's the highest rate applied to any of your income; but as a percentage of the whole $100,000, your tax is about 22.37%.The problems arise when these mathematical details are not explained properly, giving the impression, for example, that someone making $500,000 is taxed 35% on their entire income, not just on the portion greater than $373,650.

All too often the media and political figures talk about the income tax in terms of how it affects "people", not how it affects "income levels". Take this story from the USA Today:

This story is misleading and the paper should issue a correction. All tax cuts for couples making over a quarter-million will not be eliminated--they will still pay the lower rates on their incomes that fall below $250,000. The only tax hike is on the money they make past $250,000.WASHINGTON — Fresh from raising taxes on upper-income Americans to help expand health insurance coverage, President Obama and Democratic lawmakers are targeting them again.

When Congress takes up Obama's proposed $3.8 trillion budget this year, it will include extending President George W. Bush's tax cuts for middle-income families enacted in 2001 and 2003. Tax cuts for individuals with income above $200,000 and couples above $250,000 would be eliminated.

This is a pet peeve of mine: Disingenuous (or ignorant) folks who say that our progressive income tax system is unfair because some people are taxed at a different rate than others. That's entirely untrue. Every single person in the country is taxed at the same rates; everyone is covered equally under the tax laws. Everyone has their incomes below $8,375 taxed at a 10% rate. Everyone has their next $25,625 taxed at 15%. And so on.

People who argue for a flat tax are really not arguing that every person should be treated equally; they are really arguing that every dollar should be treated equally. Your first buck should be taxed at the same rate as your 250,001st, they say. I think that's nonsense. Given the costs of universal necessities--clothes, shelter, food--the government should go easy on money needed to cover the basics. And these lower tax rates should (and do!) apply to every person, regardless of their total income. But it's silly to think that an additional $10,000 for a multimillionaire has the same worth as the same amount given to a poor individual. After a certain point, the law of diminishing returns kicks in and additional money is worth less and less. At that point, why shouldn't these additional, almost worthless dollars be taxed at a higher rate?

I wish this point were emphasized more often in the media. And proponents of the progressive tax system should use the proper semantics when discussing this issue.

No comments:

Post a Comment